Random Musings

As I caught my breath after a few weeks of hectic pace – for both BVG and me personally, I thought about penning in a summary of key events of 2015 and a brief look forward to 2016.

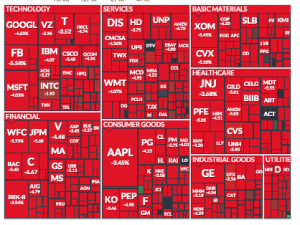

2015 – phew what a year it was! Whether it was the stock markets gyrating to Feds rate increases, or reacting to Oil prices downwards trajectory or to the Startups racing to become Unicorns & Pukicorns, (filing a trademark for this as we speak  )example reflected below, courtesy of @RobinWigg detailing the downfall of $VRX shares.

)example reflected below, courtesy of @RobinWigg detailing the downfall of $VRX shares.

It was also a memorable year both for BVG, as a group, and I, as a professional. For BVG 2015’s area of focus for startups investments were INDIA and MENA regions. The earlier part of the year saw our investment in CapitalMind.in – (A new age Financial Analytics Firm based out B’lore, India) founded by @deepakshenoy.

The second part of the year we were very impressed by what Dipesh @dipesh008 co-founder of Truelancer.com (An On-demand Freelance Marketplace ) was trying to achieve and we couldn’t pass the opportunity  to get on board. A side note here is that we connected with Dipesh @dipesh008 via twitter first – shows the power of @twitter as a powerful tool/medium for StartUps and Investors.

to get on board. A side note here is that we connected with Dipesh @dipesh008 via twitter first – shows the power of @twitter as a powerful tool/medium for StartUps and Investors.

Our investments were talked in startup arena around the world, and some were highlighted in media at iamwire, CapitalMind, PRweb, EconomicTimes and at Medianama. Yours truly was interviewed by Simon Cocking @SimonCocking at Irish Tech News – here Chat with Simon

2015 has also been the year of change at various levels but the most obvious is the website redesign of BVG which is still WIP and yes, of course, I am using @Trulancer_services for getting it done.

I also wanted to give a shout out to Jared Broad @JaredBroad the founder of QuantConnect who was gracious in having me on his Advisory Board and for the tremendous work he has put in growing QuantConnect. For those interested in algorithmic automated trading, also – strongly recommend checking QuantConnect out. Let’s take a 30 sec summary as to why we decided to invest with both @CapitalMind_In and @Trulancer_.

Major factors which endorse our decision to invest in Truelancer are:

- Most freelancer jobs go to India i.e. 38% of the total jobs.

- Highest youth population, 23.48 million, between the age group of 18-19 years.

- India ranks 3rd in terms of internet users, 243 million, which is only 17% of its population.

- Female freelancers, a hidden treasure, will act as watershed for Indian freelance industry.

Why CapitalMind?

- High growth rate of per capita income will increase investments, in turn, financial analytics will increase.

- Indian equity market is of around $1.7 Trillion, which is very alluring.

- Balanced involvement of various sectors in the Indian market, makes this market much more stable.

- Volumes in Derivatives have gone up more than 4x.

Data extracted from http://data.worldbank.org/

As a part of the investments, Blackstone Valley Group will on board their operational expertise and network and I will join the Board of Directors for both CapitalMind and Truelancer.

2016 – Looking forward, on a personal note, I am very excited to start my new role as a VP-Client Engagement & Implementation at Brightscope ( @BrightScope ). I have tremendous respect for what Mike @mikealfred along with Ryan @ryanalfred and rest of the team at Brightscope have achieved in the Retirement space using Technology to disrupt and bring transparency and change. I look forward to adding strategic and tactical value to the Brightscope team in my role by implementing key programs and initiatives that drive business outcome for BrightScope clients. Really excited to bring the change which is expected from me.

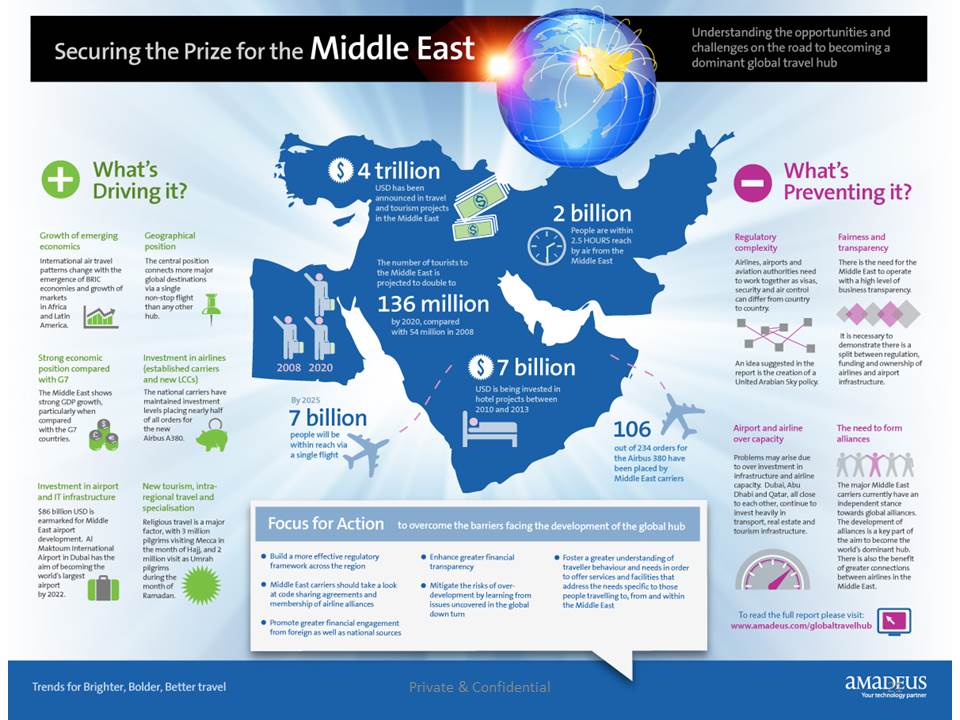

For BVG 2016, a few predictions from the “Tea Leaves” I see, Oil will rebound in the 2nd half of 2016, negative yields will spread more risk and outflows from the bond funds especially the Sovereign ones, a great opportunity for distressed corporate credit funds most of them are usually open to only institutions (yeah I heard about Third Avenue debacle), Millennials will focus more on retirement & bring more business to “RoboAdvisors” as they hate talking to people leading to demands for greater data quality & transparency from the legacy systems of broker-dealers – some of which ( @BrightScope ) is stewarding, & last but not the least to keep the focus on the MENA region there are a few startups that caught our attention are on our favorite list, so watch this space and twitter for news as it happens.

And yes www.pukicorns.com is for real, just waiting for the some of the lofty valued Unicorns to bite the dust

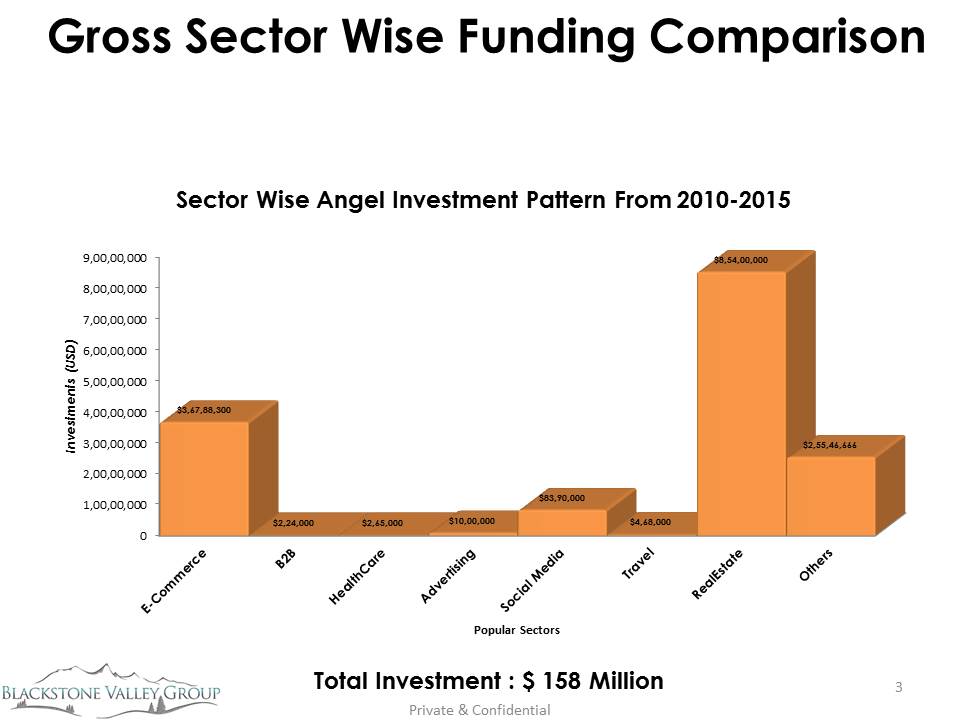

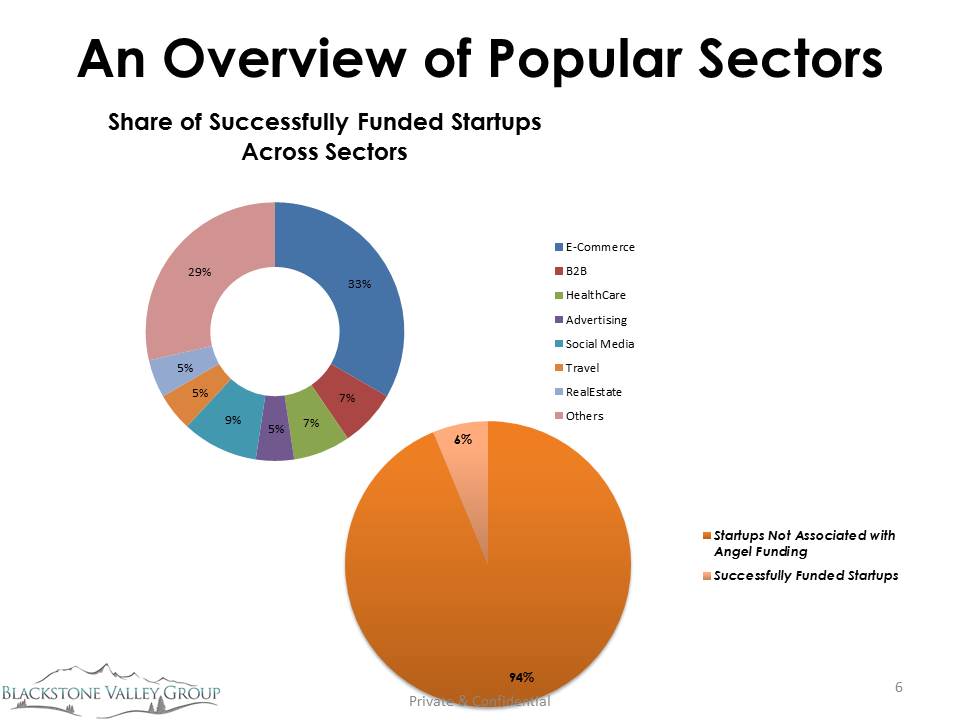

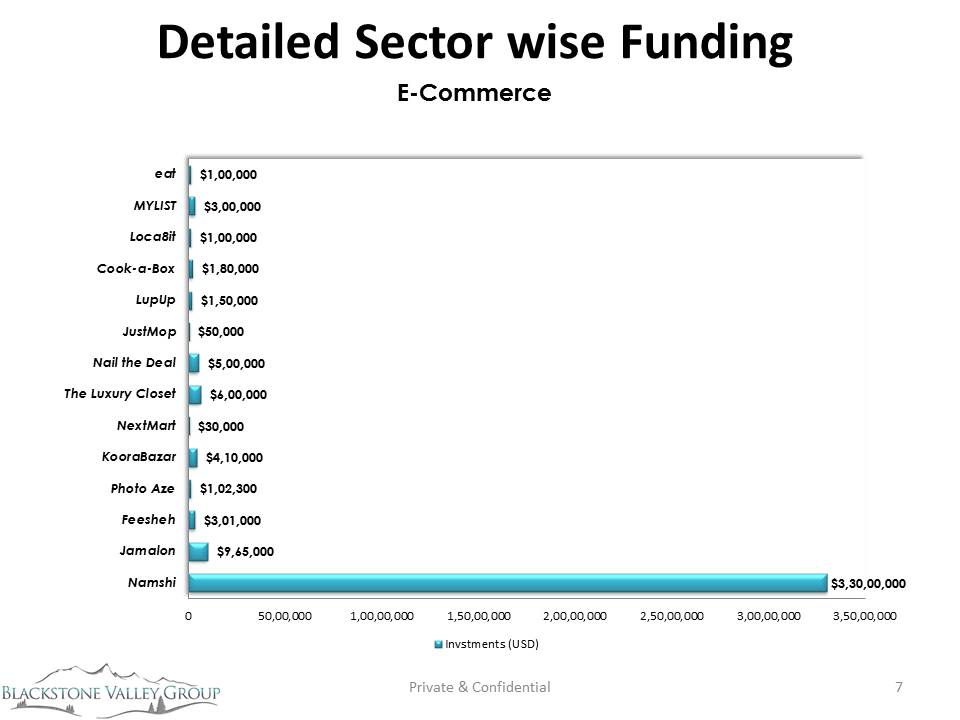

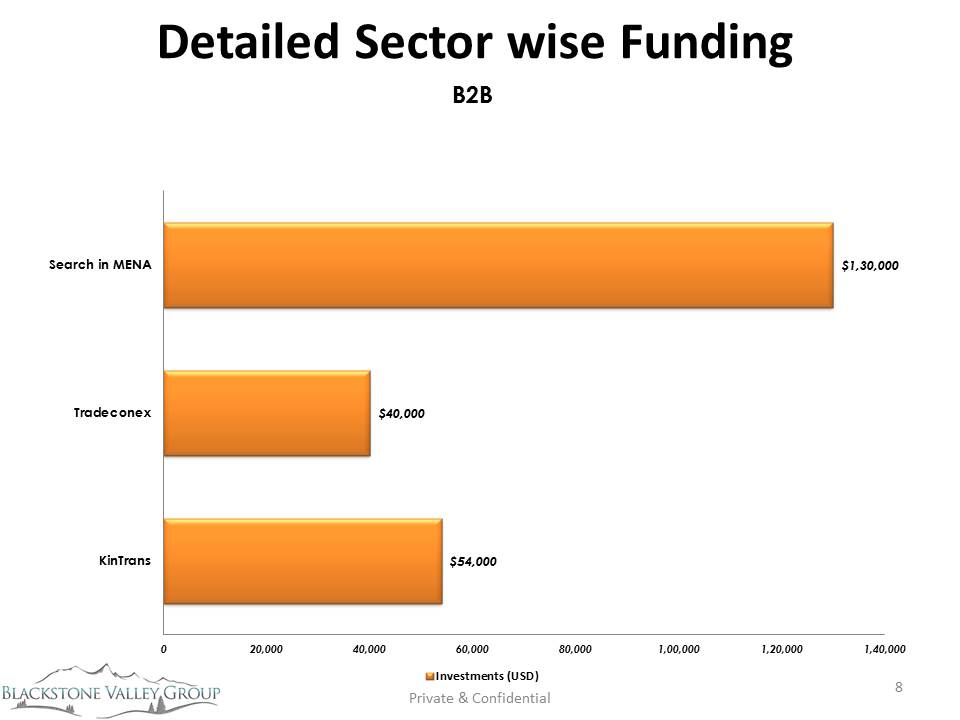

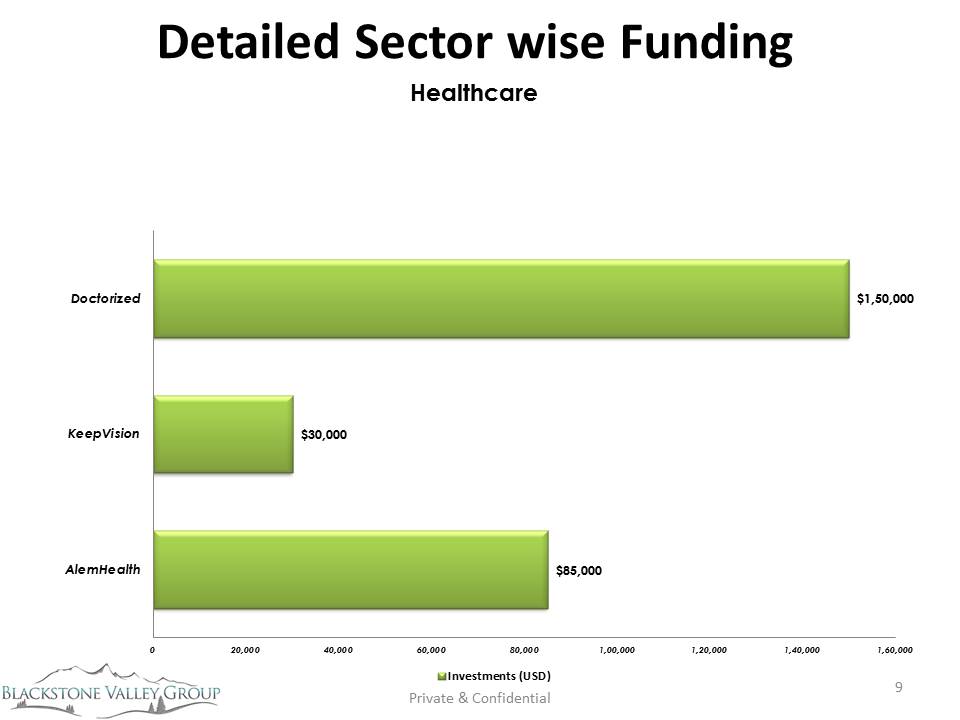

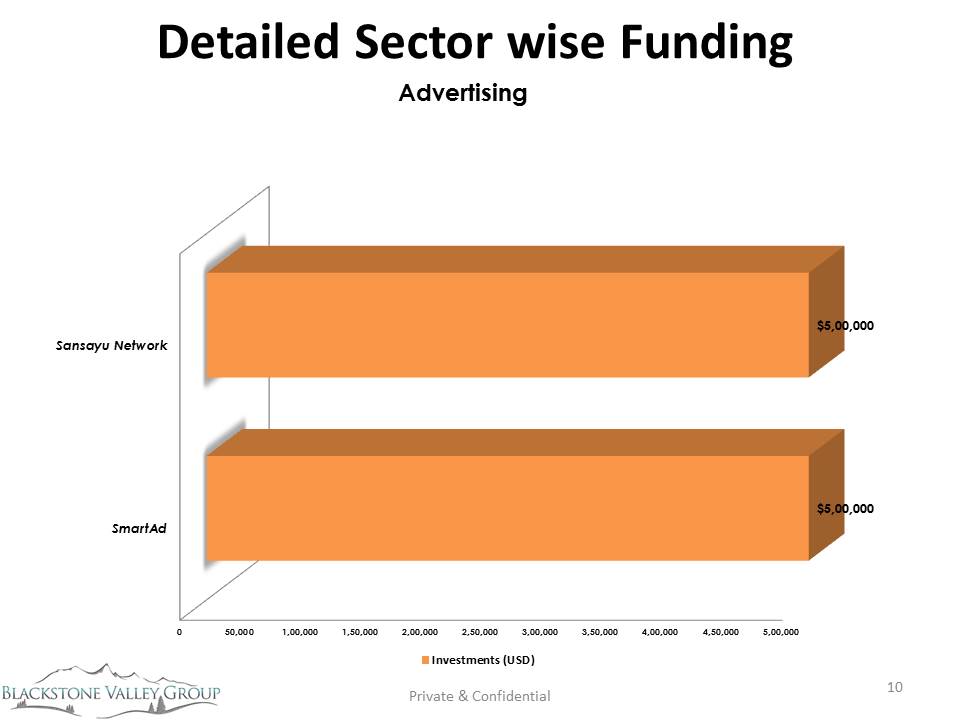

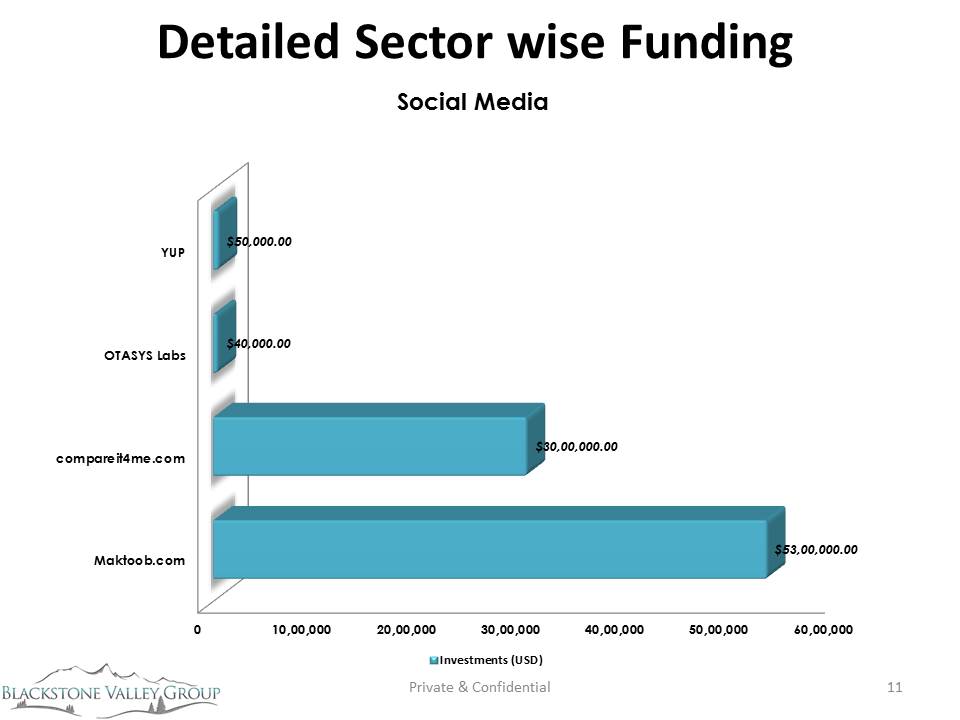

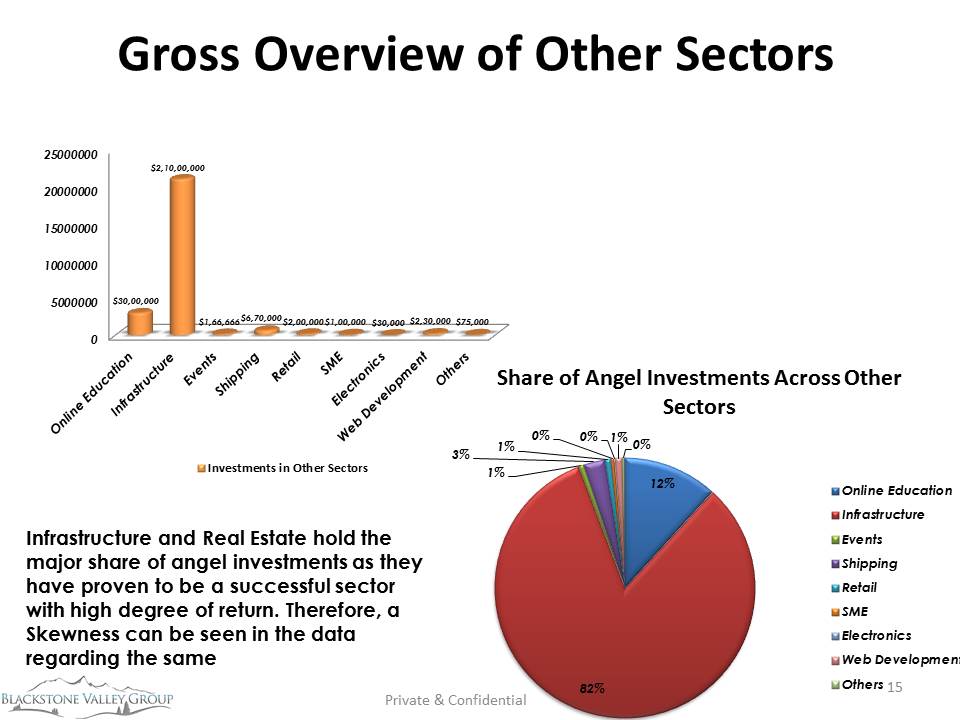

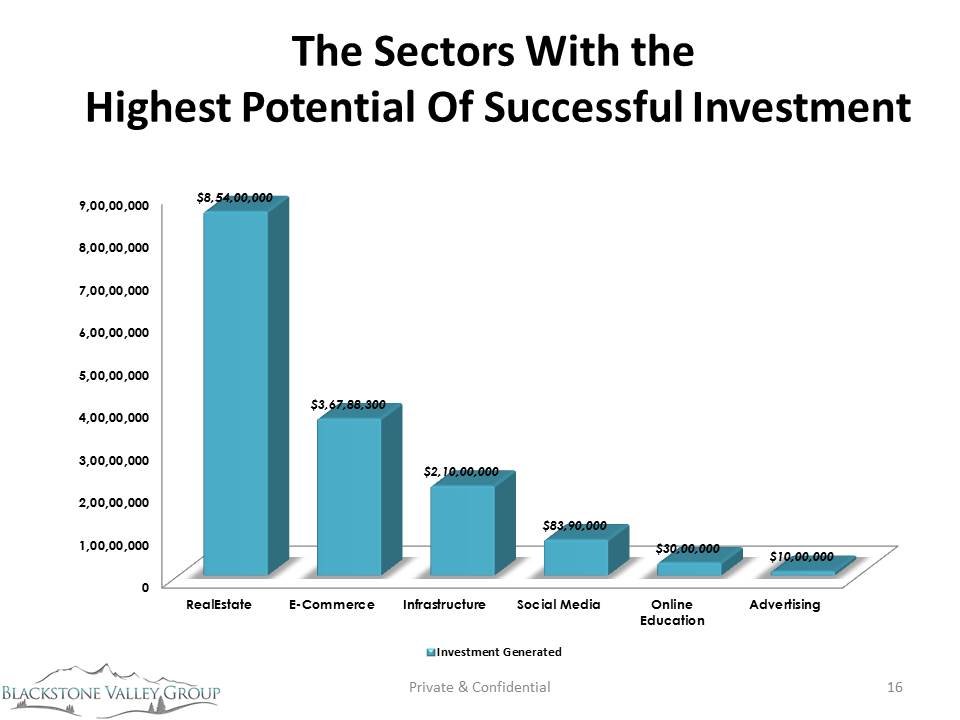

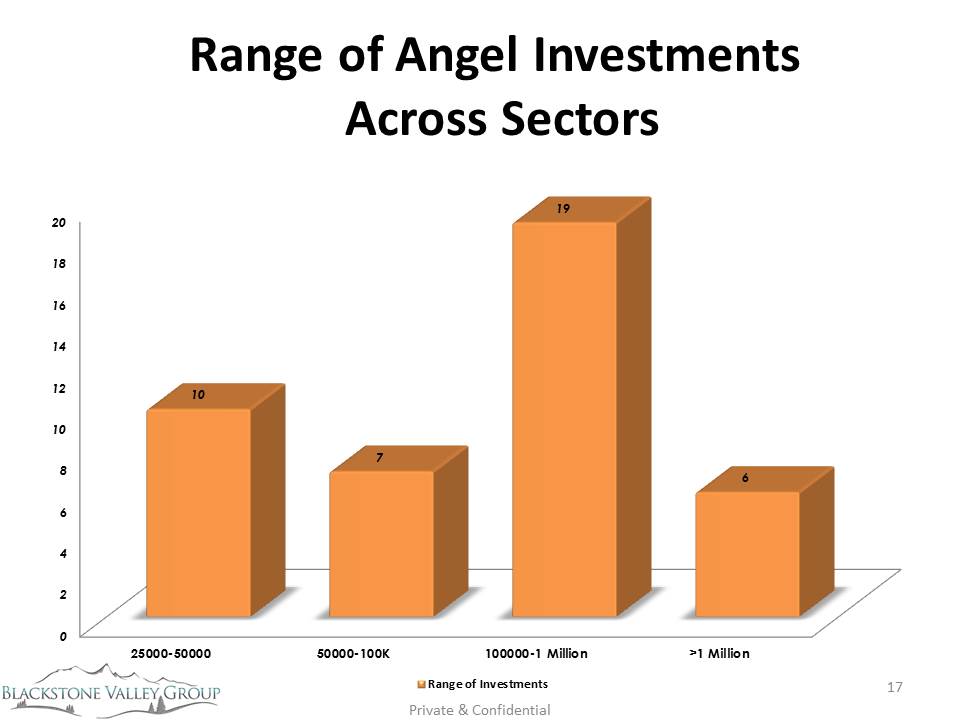

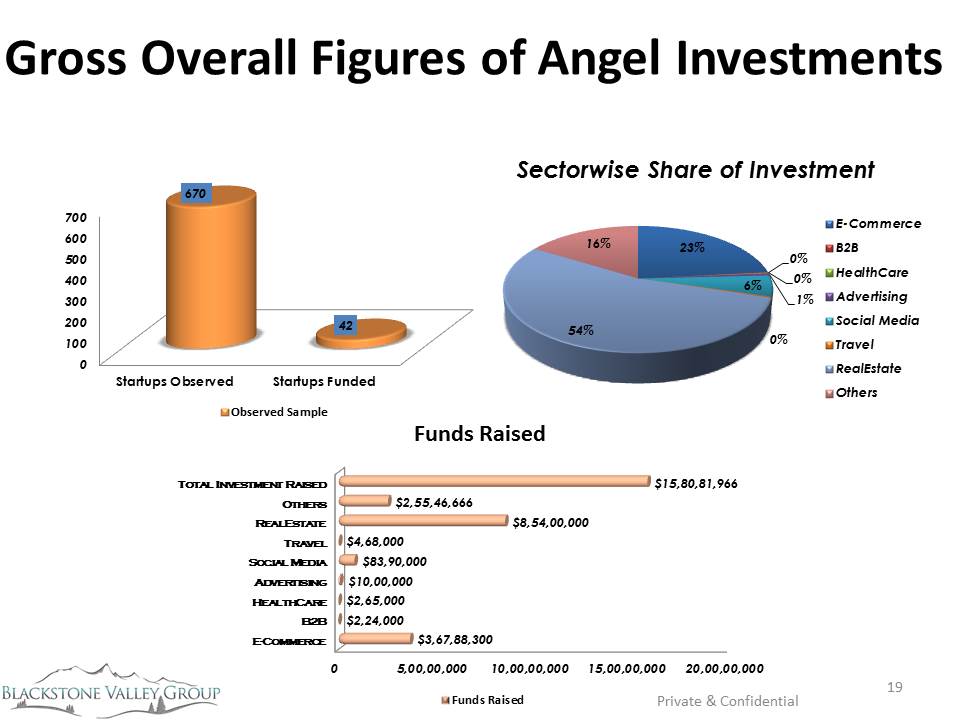

Here is a link to a Linked-In post MENA Region Angel Investment, I did a few weeks ago detailing the opportunity and state of the StartUp ecosystem in the MENA region.

A journey towards the summit has just begun and the year 2016 will mark the inception of this voyage. As usual comments/feedbacks welcome. Please do follow @BlackstoneVG, thanks for reading and your support.

I decided to write about this and the implications for the startup world but then who better than Mark Suster (GP -UpfrontVentures) to explain the co-relations here (

I decided to write about this and the implications for the startup world but then who better than Mark Suster (GP -UpfrontVentures) to explain the co-relations here (