Markets – A Swing Story of 2-Days (Investments)

Hello Folks, what an interesting year so far. We have Unicorns, Stock market crashes and central bankers now playing the roles of Super Heroes and everyone wondering about the Co-Relation between the stock market gyrations and Start Up – VC funding.

I decided to write about this and the implications for the startup world but then who better than Mark Suster (GP -UpfrontVentures) to explain the co-relations here (http://goo.gl/bRJMzD) – a must read!

I decided to write about this and the implications for the startup world but then who better than Mark Suster (GP -UpfrontVentures) to explain the co-relations here (http://goo.gl/bRJMzD) – a must read!

Its been a very busy year with travel, work, working with portfolio companies and deal flows (phew) the highest deal flow which I have seen come across in the last 3 years – is it the market, is it because we are now starting to be known around the block (a very tiny block), is it my increased social media adventures, (YouTube https://goo.gl/H8U4EK , https://goo.gl/pdqhs1 ) or tweeting @BlackstoneVG ☺ (https://goo.gl/jpKR5d ) don’t know but it has been good.

The tough part has been getting back to all the entrepreneurs in time and there I have failed. I pride myself for a zero inbox policy and a response within 24 hrs yet, I found consistently falling behind. I apologize again to all the founders/entrepreneurs who got delayed responses from our side – its my fault and have taken steps to ensure that we are able to deal with this more efficiently.

So What’s on Tap? Well for the most part – looking at the quality of the deal flows I expect us to be busy in getting involved with more startups in different capacities and maybe looking at a few mature ones too. One thing I realized is that not everyone is looking for $$ but some are looking for direction, guidance and a bit of mentoring. This is especially important for first time entrepreneurs and especially those who haven’t had the break of getting in through Y-Combinator or any of the other accelerators. I am firm believer that ecosystems do matter in nurturing and guidance in early stages – which can often make a difference between a successful startup – Unicorn or Not.

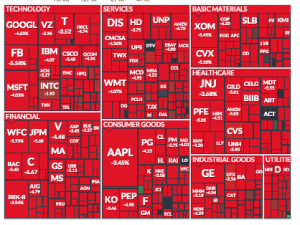

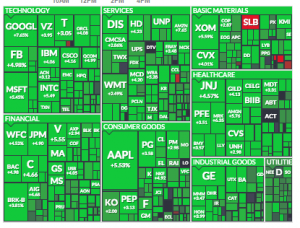

Figure 2 US Equtiies Markets as of 08/24/15 –ht FinViz

As I started winding down my post here is how the market closed today…go figure ☺

I want to keep it short and sweet and let you go with a question…

Which commodity has had the biggest price increase (% change from previous month) June ’15 to July ‘15?

Please email your replies to rvohra@blackstonevalleygroup.com

Or tweet them to @BlackstoneVG.

Thank You!

For reading and your continued support!