Happy 2015 – BVG

Happy New Year 2015– BlackstoneValleyGroup

Hello Folks, it has been a long time since I took to blogosphere to share my thoughts and updates – the delay is a result of me trying to manage my time and juggle across many priorities!

2014, seems to be a bumper harvest year for all sectors –We saw record IPOs – Alibaba ($24 Billion) & VC firms seemed to have abandon the “Millions “in company valuations as they raced with each other to catch the Ubers, HomeJoys, Lyfts and make your head spin with every new investment round pushing the B in Billion higher! Hey Angels weren’t left that far behind… Angel investing took an interesting turn with a couple of big Angel Investors now leading Series A round themselves!

So how did we do – The pic below is a powerful indicator of what we didn’t accomplish much in 2014 –we came very close to inking 3 deals but no Cigar. 150% effort but nothing to show for it :)For 2015 – we have dry powder and we are on the hunt!

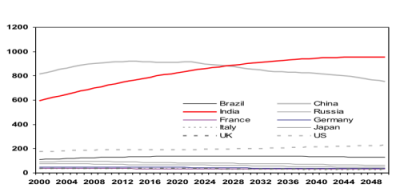

àLet us take a look at why our focus is on BIM for the next few years: Labor Force in Millions! And the Emerging Middle Class!

Source:IMF 2014

These are huge marketplaces by themselves. Let me share some stats —

Brazil: Urban population: 87% of total population (2010)

Rate of urbanization: 1.1% annual rate of change (2010-15 est.)

Total Population: 202,656,788 (July 2014 est.), with over 44% in (25-54 years age bracket)

India: Urban population: 31.3% of total population (2011)

Rate of urbanization: 2.47% annual rate of change (2010-15 est.)

Total Population: 1,236,344,631 (July 2014 est.), with over 41% in (25-54 years age bracket)

Mexico: Urban population: 78% of total population (2010)

Rate of urbanization: 1.2% annual rate of change (2010-15 est.)

Total Population: 120,286,655 (July 2014 est.), with over 40% in (25-54 years age bracket)

{note: Mexico City is the second-largest urban agglomeration in the Western Hemisphere, after Sao Paulo (Brazil), but before New York-Newark (US)

(Source: World Factbook)

Ok – That is our stat section – now time for Hat Tipping and acknowledging some of the biggest influencers on me personally. Warning! I am going to name drop in a big way here …with a full disclosure that I do not know any of these great individuals nor do I have any delusions of them having heard about me (but it is on my bucket list to meet all of them –Ahem!).These game changers are leading the wave of innovative approaches to entrepreneurship and crafting a path for the baby angels (newbies like us to follow :)!

Ben Horowitz /Marc Andreessen (Co-Founders of www.a16z.com )

Peter Theil (www.foundersfund.com)

Bill Gurley (www.benchmarkcapital.com)

Mark Suster (http://www.bothsidesofthetable.com)

Jason Calcanis (www.calcanis.com)

Gil Penchina (www.angel.co/penchina)

As a side note, Ben also wrote the best business management book out there – The Hard Thing About Hard Things” (if you haven’t read it please put in on your reading list)

And that’s it – I do promise to at least a quarterly if not more frequent update! Please hit me on twitter @BlackstoneVG or I can be reached at rvohra@blackstonevalleygroup.com

but cant hide – we will find you!

but cant hide – we will find you!